defer capital gains taxes indefinitely

Instead of their equity going toward the payment of income. Sell the Property After 1 Year.

Sponsored Do Upreit Exits For Dst Programs Allow Investors To Avoid Capital Gains Tax Indefinitely The Di Wire

In theory there could be a successive series of exchanges that defer capital gains taxes indefinitely which allows an investors income to grow tax-free over a long period of time.

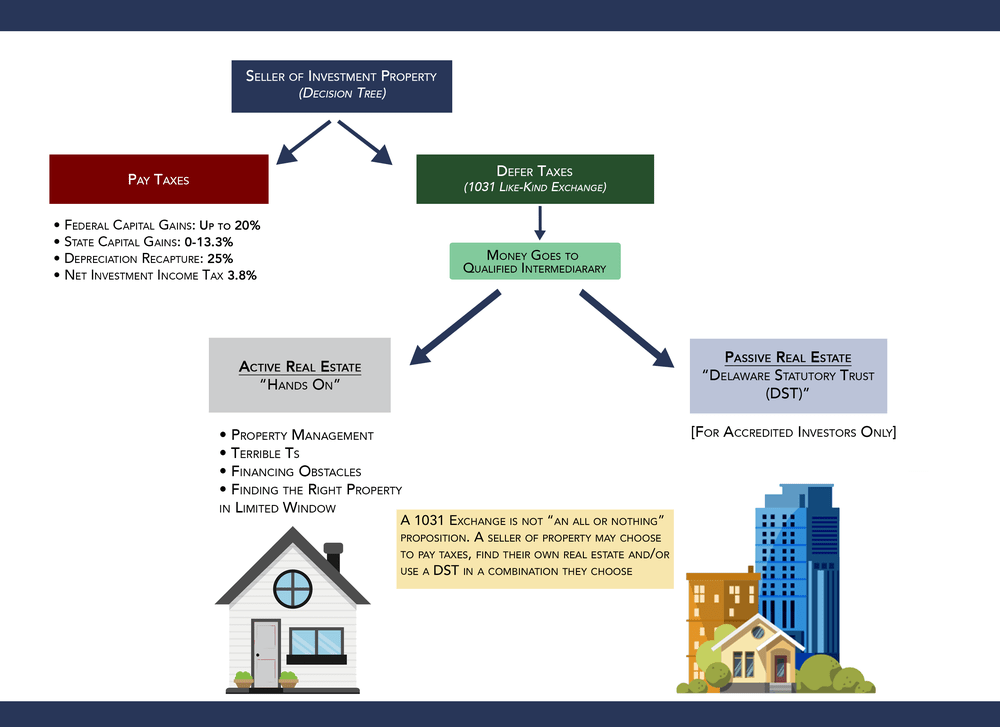

. Their capital gain taxes and depreciation recapture taxes can be deferred indefinitely by continually structuring and using 1031 Tax Deferred Exchange strategies. Over one-fifth of your hard-earned income is lost immediately after completing. You may avoid paying capital gains on the sale of the property with a 1031 exchange if you are using the real estate as an investment to generate income for yourself.

How to Defer Tax on Capital Gains Tax-Deferred Exchange. Defer Capital Gains in a 1031 Exchange. A 1031 exchange allows a seller to sell an.

453 one will not find the words. Anyone can defer capital gains taxes indefinitely using a Deferred Sales Trust. By performing a 1031 exchange investors defer capital gains tax indefinitely as long as they continue to reinvest the principal in the property.

A 1031 exchange or like-kind exchange lets you defer taxes on the sale of an investment property by using the proceeds to buy another property. Structuring real estate transactions as 1031 tax-deferred exchanges allows an Investor to defer 100 of their income tax liabilities. Wait at least one year before selling a property.

If you sold your practice for 4 million you could end up paying 800000 to 13 million in capital gains taxes. The good news is there remain ways to reduce capital taxes or even to eliminate them altogether. Well Id like to introduce you to a little something called the 1031 ExchangeMany savvy investors use this to multiply their returns and defer capital gains tax on the sale of their.

While investing in real estate through the buying and selling of property can be a lucrative endeavor in order for an. There can be a big difference in the rate so it may make sense for some investors to wait at least one year before selling a property. If the son were to sell the real estate later for 1000000 the.

Short term capital gains are taxed as ordi See more. 6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. If the son were to immediately sell the real property for 650000 there would be no capital gain income taxes owed by the son.

Normally to defer the taxable capital gains into a QOF the profit must be reinvested into a QOF within 180 days of the sale date. As long as you use the. Leverage the IRS Primary Residence.

One year is the dividing line between having to pay short term versus long term capital gains tax. While investors can defer the tax by means of this strategy it should also be noted that they cannot use a short sale to convert a short-term capital gain into a long-term gain taxed at a. First of all a Deferred.

You can defer payment of CGT by re-investing the capital gain into an. There are some strict rules and regulations around a 1031 exchange but it does allow you to defer paying capital gains taxes. Your first question might be what is a Deferred Sales Trust Good question.

A Quick Guide To Capital Gains Taxes On Rental Properties Arrived Homes Learning Center Start Investing In Rental Properties

How To Defer Avoid Paying Capital Gains Tax On Stock Sales Hbla

Capital Gains Tax In The United States Wikipedia

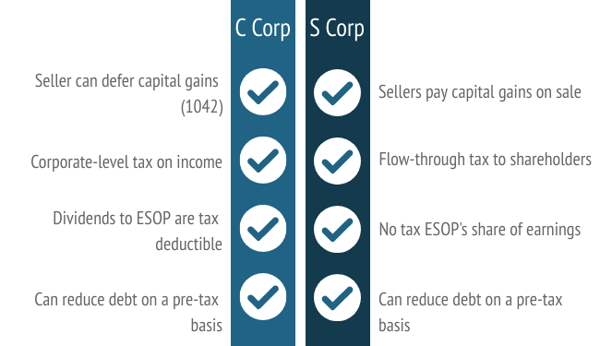

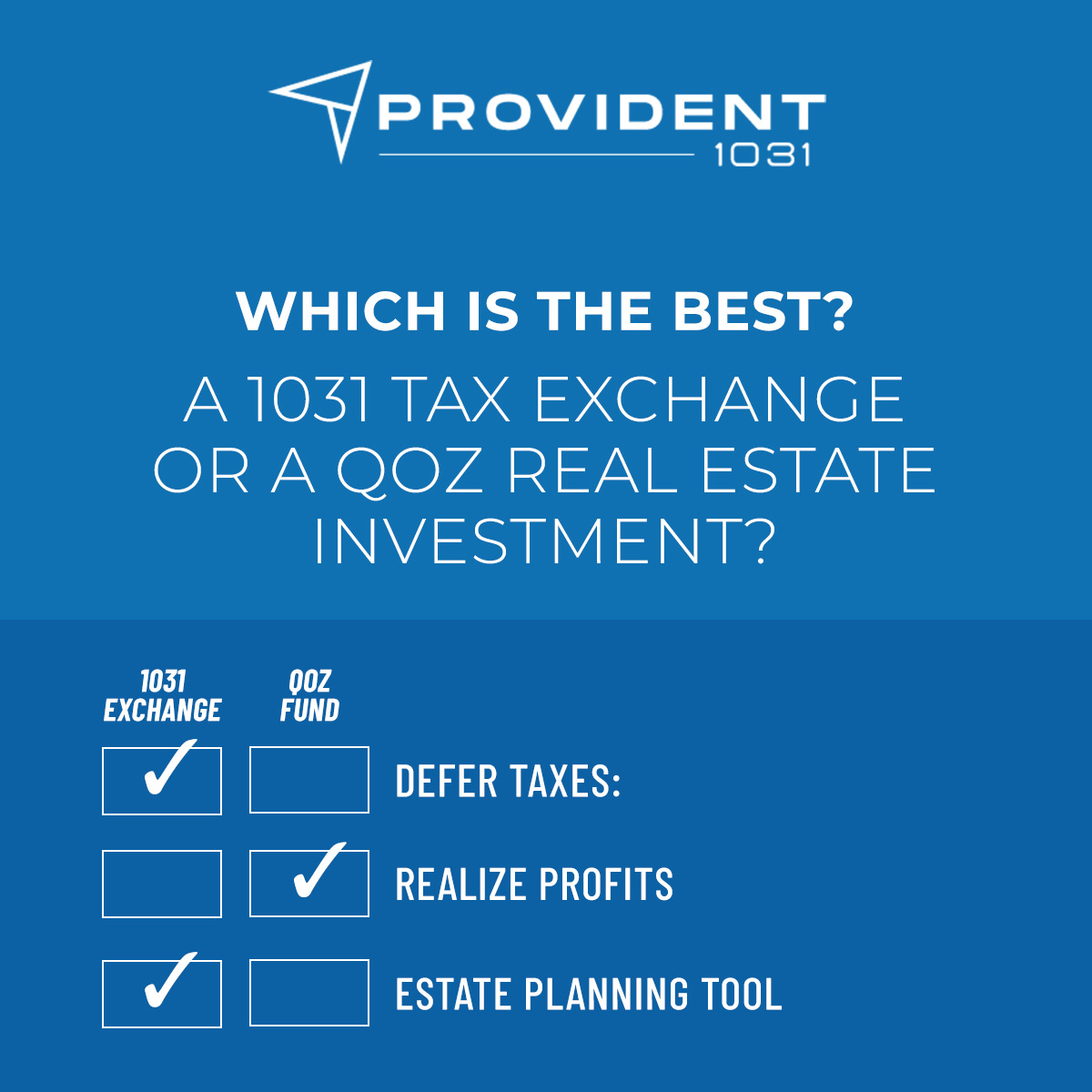

1031 Exchange Vs Qualified Opportunity Zones

Nyc Swap Tactic Lets You Defer Capital Gains Tax Tax Services Nyc

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

How To Avoid Capital Gains Tax In Real Estate Mybanktracker

How To Pay No Capital Gains Tax After Selling Your House

How To Defer Capital Gains Taxes Forever Ram

How Capital Gains Affect Your Taxes H R Block

Defer Capital Gains Using Like Kind Exchanges Caras Shulman

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Ep 97 1031 Exchanges How To Defer Capital Gains Tax On Properties

How To Avoid Capital Gains Tax On Appreciated Stock Positions

Biden Targets A Tax Break That Helped Trump Build His Fortune Crain S Chicago Business

Farmland Sellers And Capital Gains Taxes On Sale Peoples Company

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy